As a U.S. citizen, I understand our taxes go towards paying for things we as a society feel are necessary. This includes educating our children, repairing our roads, and providing affordable housing and medical insurance. At the end of the day, somehow, someway, these priorities must be funded, and it’s up to all of us. However, somewhere along the way, we have turned taxes into a burden for those least able to afford them, while those living in luxury, without a financial care in the world, have been able to shirk their responsibilities. Simply put, this is unAmerican, and another round of tax cuts will only bring us farther from our values.

One of our values is the belief that all citizens able to should pay their fair share and that everyone should have an equal say in how our government functions. Unfortunately, this is no longer the case, and politicians frequently show how much more they value certain groups of taxpayers when they decide how much the different classes pay, and on what. They are able to do this because, frankly, tax policy is boring and often does not seem to have any bearing on the everyday lives of the working Americans.

For example, the majority of Americans do not have any money in stocks, and will most likely never have enough savings to invest. Republicans and their donors have capitalized on this truth by spewing falsehoods in favor of a capital gains rate that is half that of the highest earned income rate. In doing so, Republicans are showing they value investors more than salaried and hourly workers under the guise of encouraging investing, which they say is only likely to happen when conditions favor investors. This is simply untrue. Investors do not need to be encouraged to invest. Investing is going to happen whether the tax rate goes up or down because the alternative is to do nothing and let their money sit in a bank account or under their mattress. Keeping 60% of the investment profits or keeping 80% of the investment profits are both a lot better than getting no profits at all.

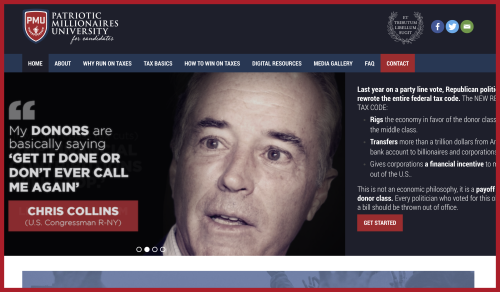

Unfortunately, millions of Americans were not privy to this last year, and Republicans were able to successfully lower the taxes of the investor class. With Tax Cuts 2.0 around the corner, this truth, and many others, need to be amplified and easily accessible. This is where Patriotic Millionaires University comes in.

Created in the aftermath of the Tax Cuts and Jobs Act, PMU rejects the notion that only economists can weigh in on tax policy. Rather, PMU gives everyone the ability to master the tax debate with no stone unturned. With instructions in how to frame the argument, talking points, statistics from trusted pollsters, in-depth analysis of current tax legislation, and real world examples, PMU is the most complete deep-dive into how to argue tax policy outside of a textbook.

This fall, Republicans hope to pass another round of tax cuts, and after last year’s success they’re feeling confident. If successful this time around, these cuts will be another boon to the donor class at the expense of millions of middle class Americans. With PMU, voters can be equipped with the thorough, concrete facts necessary to discuss tax policy and ultimately fight Tax Cuts 2.0.