For Immediate Release

Monday, June 16, 2025

Report: 3% Wealth Tax on G7’s Centi-Millionaires Could Raise $411 Billion Annually

KANANASKIS, ALBERTA, CANADA – The United States, Canada, and other G7 countries could raise $230 billion per year with a 3% wealth tax on billionaires, or $411 billion per year with a 3% wealth tax on centi-millionaires, according to a new report released today by Patriotic Millionaires Canada. The release of the report— Fighting Wealth Inequality in the G7: Revenue Estimate for Wealth Taxes—coincides with Canada hosting the G7 this week.

The report was previewed at an event in Ottawa on June 11th, co-hosted by Patriotic Millionaires Canada, Oxfam Canada, Oxfam Quebec, and Canadians for Tax Fairness. The groups stressed how the newly elected Canadian government should use its position hosting the G7 to promote a global agenda that prioritizes tax fairness.

Key findings from the report include:

- G7 countries could raise $411 billion per year with a 3% wealth tax on centi-millionaires, or $230 billion with a 3% wealth tax on billionaires

- G7 countries could raise $214 billion per year with a 2% wealth tax on centi-millionaires, or $138 billion with a 2% wealth tax on billionaires

- The United States could raise $288 billion per year with a 3% wealth tax on centi-millionaires, or $161 billion with a 3% wealth tax on billionaires

- The United States could raise $146 billion per year with a 2% wealth tax on centi-millionaires, or $94 billion with a 2% wealth tax on billionaires

- Canada could raise $18 billion per year with a 3% wealth tax on centi-millionaires, or $10 billion with a 3% wealth tax on billionaires

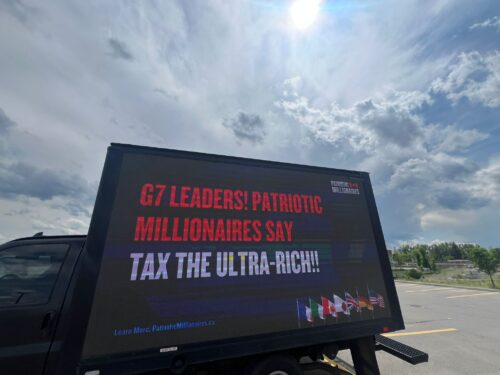

The release of the report was accompanied by a panel truck circling the G7 leadership conference area, highlighting several key facts and messages from the report. Below is a photo of one of the panels on the truck:

“Extreme wealth inequality is ripping apart our economies, democracies, and shared planet. We’re seeing this play out in real time in the United States with billionaire Donald Trump back in office, as he wrecks livelihoods and throws out democratic norms and standards for his own personal benefit,” said Morris Pearl, Chair of Patriotic Millionaires and a former Managing Director at BlackRock. “The solution to the dangerous rise of oligarchy both here in America and around the world is devastatingly simple: enact a wealth tax like the one outlined in this report on rich people like me. It is imperative that the G7 leaders meeting in Canada this week understand this basic truth and act on it before it’s too late.”

“This is a test of the new Carney administration,” said Patriotic Millionaires Canada Board Member Sabina Vohra-Miller. “They’re stepping out onto the international stage, and they have a chance to be a leader in taxing extreme wealth and pushing back against global oligarchy. Encouraging other countries to join them will only make these taxes more effective and tax evasion and avoidance more difficult.”

The data used in the report was provided by the EU Tax Observatory, an independent research laboratory hosted by the Paris School of Economics and directed by world-renowned economist Gabriel Zucman. Patriotic Millionaires Canada is a new chapter of Patriotic Millionaires, bringing together wealthy Canadians who are concerned about economic inequality and seek to advocate for policies to effectively tax the rich.

For additional information or interview requests, please contact Emily McCloskey at emily@patrioticmillionaires.

# # # # #